Punjab Rozgar Scheme 2026

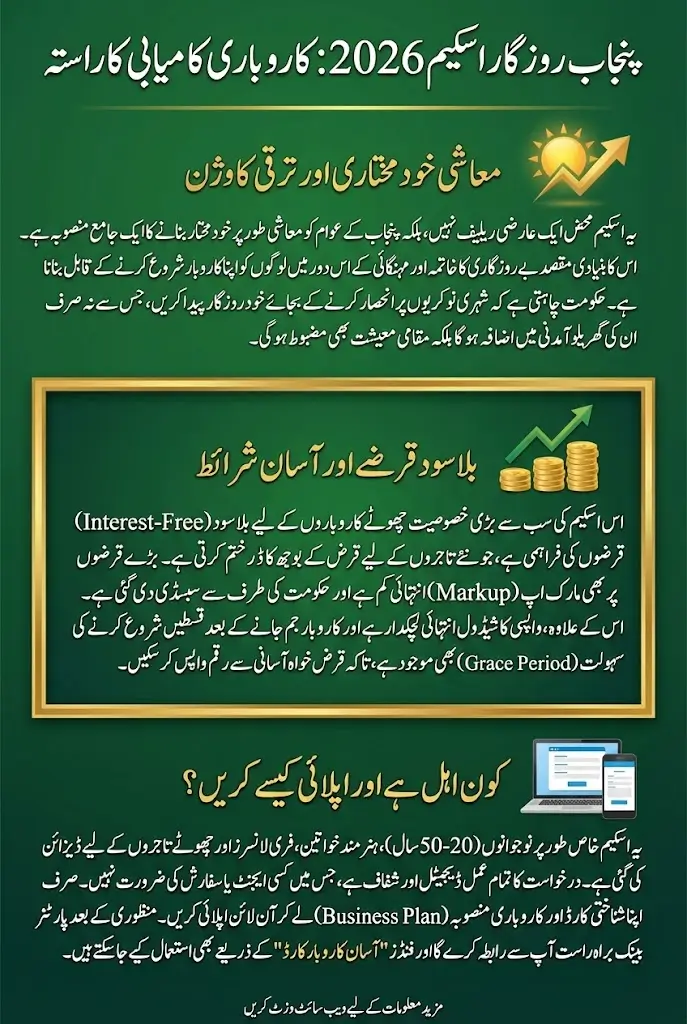

Punjab Rozgar Scheme 2026 is one of the most practical and timely initiatives launched by the Punjab government to tackle unemployment and rising business costs. Over the past few years, I have seen many educated and skilled people in Punjab struggle to earn a stable income, not because they lack ideas or experience, but because they do not have access to affordable financing. This scheme directly targets that problem by providing interest-free and subsidized loans through a transparent and digital system.

Unlike temporary relief packages, this program focuses on building long-term earning opportunities. It encourages people to move away from dependency on jobs and instead create their own businesses. Whether someone wants to open a small shop, start freelancing, or expand an existing setup, the Punjab Rozgar Scheme 2026 offers structured financial support that is realistic and accessible.

You Can Also Read: Basant Festival 2026 Date Announced

Vision Behind Interest-Free Business Financing

The vision behind the Punjab Rozgar Scheme 2026 is rooted in economic self-reliance. The government recognizes that real development happens when citizens are empowered to earn independently rather than rely on aid or unstable employment. Interest-free financing plays a critical role in this process because it removes the fear of debt that discourages many people from starting a business.

By absorbing the markup cost for certain loan categories, the government ensures that borrowers are not burdened in the early stages of their business. This approach reflects a long-term strategy aimed at strengthening small enterprises, stabilizing household incomes, and improving overall economic activity across Punjab.

You Can Also read: Imam Masjid Registration Phase 2 Begins in Punjab

The core objectives of this financing model include:

- Promoting entrepreneurship instead of job-seeking

- Reducing unemployment through small businesses

- Encouraging responsible borrowing and repayment

- Strengthening local and community-based economies

Who the Scheme Is Designed For

This scheme is designed for individuals who have the ability to run a business but lack financial backing. It covers a wide segment of society, including first-time entrepreneurs and small business owners who want to expand their operations. From my observation, many people already run small setups but remain stuck at the same level due to lack of capital, and this scheme gives them a chance to move forward.

The program specifically focuses on financially excluded groups who are often ignored by commercial banks. These include youth, women, freelancers, skilled workers, and small traders. However, the scheme also maintains discipline by ensuring that only serious applicants with workable plans are approved.

It mainly targets:

- Unemployed and underemployed youth

- Women managing home-based businesses

- Freelancers and skilled professionals

- Small traders and service providers

You Can Also read: BISP Biometric Issue Resolved: Facial Recognition

Age, Residency, and Identity Requirements

To ensure transparency and proper use of public funds, the Punjab Rozgar Scheme 2026 has clearly defined eligibility criteria. Applicants must be permanent residents of Punjab and possess a valid CNIC. This helps authorities verify identity and prevent misuse of the scheme.

The age criteria are set in a way that includes both young individuals and experienced professionals. Generally, applicants between 20 and 50 years are eligible, while professionally qualified individuals can apply up to the age of 57. These conditions ensure that the scheme remains inclusive without compromising financial responsibility.

You Can Also read: Gold Price In Pakistan Per Tola Today

Business Ideas Accepted Under the Scheme

One positive aspect of this scheme is that it does not limit applicants to modern or urban-based businesses only. Traditional businesses that support local markets are equally encouraged. From small retail shops to agriculture-related ventures, the program supports a wide range of income-generating activities.

The key requirement is not the size of the business, but its feasibility and sustainability. Authorities look for realistic ideas that can generate steady income and support repayment. This balanced approach ensures that both rural and urban applicants can benefit equally.

Eligible business areas include:

- Retail and wholesale trading

- Agriculture and livestock services

- IT services, freelancing, and e-commerce

- Manufacturing, workshops, and repair units

- Food services, education, and professional work

You Can Also read: Green Credit Program 2026

Special Financial Access for Women Entrepreneurs

Women empowerment is a central focus of the Punjab Rozgar Scheme 2026. In many parts of Punjab, women possess strong skills but face difficulties accessing formal financial systems. Social barriers, lack of collateral, and limited mobility often prevent them from obtaining loans.

This scheme prioritizes women applicants, especially those running home-based or small-scale businesses. By providing interest-free and subsidized loans, it allows women to contribute financially to their households while maintaining work-life balance. Over time, this financial inclusion helps improve family stability and social empowerment.

Common women-led businesses supported under the scheme include tailoring, beauty services, online selling, food catering, and training services.

You Can Also read: PAVE Scheme Electric Bikes and Rickshaws

Youth-Centered Business Opportunities

Youth entrepreneurship is another strong pillar of the Punjab Rozgar Scheme 2026. With limited job openings in both government and private sectors, young people are increasingly turning toward self-employment. This scheme encourages that shift by supporting skill-based and technology-driven businesses.

Applicants with vocational training, technical skills, or digital expertise are given preference. Youth-led businesses not only help individuals earn but also create employment for others. This ripple effect contributes to long-term economic stability.

High-demand youth business areas include freelancing, IT services, mobile repair, creative work, and online commerce.

You Can Also read: BISP 8171 Result Check By CNIC For 13500 Payment

Loan Categories and Funding Options

To accommodate different business needs, the scheme offers flexible financing options. Applicants can apply for funding based on whether they need capital investment or working capital. This flexibility ensures that businesses at various stages can benefit.

| Loan Type | Purpose | Suitable Businesses |

|---|---|---|

| Capital Financing | Equipment, machinery, setup costs | Workshops, manufacturing units |

| Working Capital | Inventory, utilities, transport | Shops, service businesses |

This structure allows applicants to choose financing that matches their actual requirements.

You Can Also read: Shab E Barat 2026 Date In Pakistan – Night of Mid Shaban

Interest-Free Structure and Subsidized Markup Model

One of the most attractive features of the Punjab Rozgar Scheme 2026 is its interest-free loan option for small businesses. This feature removes the biggest fear associated with borrowing, especially for first-time entrepreneurs.

For higher loan amounts, minimal markup is applied, but most of it is subsidized by the Punjab government. Compared to commercial bank loans, this significantly reduces repayment pressure and encourages responsible business growth.

You Can Also read: Silver Rate Today In Pakistan – 1 Tola Chandi

Digital Application and Transparency System

The entire application process is online, which eliminates the role of agents and middlemen. Applicants register using their CNIC and mobile number and submit all required information digitally. From what I have seen, this system reduces corruption and ensures equal opportunity for everyone.

Applicants receive updates through SMS or email, and once approved, partner banks contact them directly. This transparent process builds trust and confidence among citizens.

You Can Also read: Xiaomi 18 Hardware Features Surface in New

Documents Needed for Application Approval

Applicants are required to submit basic documents that help authorities assess identity and business feasibility. The process is simple but structured to ensure seriousness.

Required documents include:

- Valid CNIC

- Proof of residence

- Recent photograph

- Business idea or proposal

Providing additional documents such as training certificates or licenses can improve approval chances.

You Can Also read: New PTA Tax Values For Samsung Galaxy S23 Series

Asaan Karobar Card and Digital Spending Facility

The Asaan Karobar Card is a supportive facility designed for micro-entrepreneurs and freelancers. It provides digital credit that can be used for daily business expenses such as utility bills, supplier payments, and taxes.

This card helps small businesses manage cash flow efficiently while maintaining transparency in spending.

Repayment Schedule and Ease for Borrowers

Repayment plans under the Punjab Rozgar Scheme 2026 are flexible and borrower-friendly. Applicants can choose monthly or quarterly installments depending on their income cycle. Grace periods allow businesses to stabilize before repayments begin.

Clear repayment schedules help borrowers plan finances and avoid defaults, which protects both the borrower and the system.

Economic Impact on Punjab’s Local Markets

When small businesses grow, local economies strengthen. This scheme contributes to job creation, increased household income, and reduced unemployment. It supports both rural and urban markets, creating balanced economic growth across Punjab.

Why Punjab Rozgar Scheme 2026 Stands Out

What makes this scheme different is its focus on sustainability, dignity, and transparency. Instead of pushing people into debt, it supports them responsibly. Its digital governance, interest-free structure, and inclusive approach make it one of the strongest business financing programs in Punjab.

You Can Also read: Benazir Kafalat New Qist: New vs Old Beneficiaries

Final Thoughts

Punjab Rozgar Scheme 2026 offers a real opportunity for youth and women to take control of their financial future. It is not just a loan program, but a pathway toward independence and stability.

For anyone in Punjab with a practical business idea and the determination to work hard, this scheme provides the support needed to turn that idea into a sustainable source of income.