PTA Tax Reduction

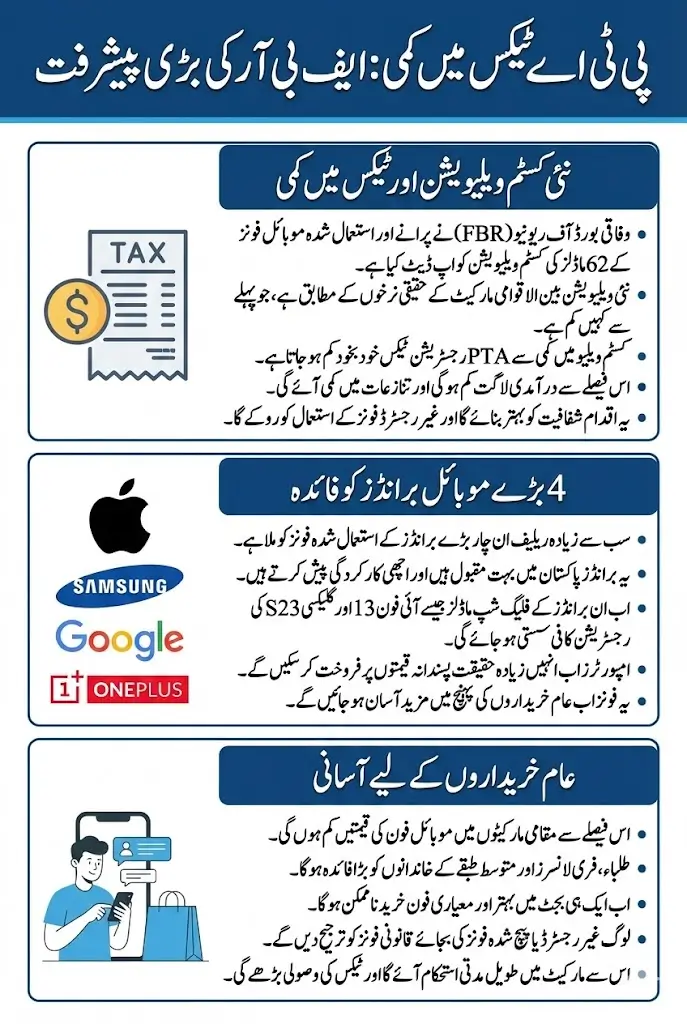

The Federal Board of Revenue (FBR) has announced a decision that directly impacts millions of mobile phone users across Pakistan. At a time when the price of smartphones has gone beyond the reach of many ordinary citizens, this step has provided much-needed relief to buyers who rely on imported used phones.

In Pakistan, owning a smartphone is no longer a luxury. It is a daily necessity for banking, education, online work, and communication. However, high PTA taxes and unrealistic customs valuations were making even used phones unaffordable. This new policy corrects that imbalance and brings prices closer to what people actually earn and spend in real life.

From what I have personally observed in local mobile markets, this change was being discussed for months. Traders, buyers, and even customs staff were frustrated with outdated values that no longer reflected ground reality.

You Can Also Read: 8171 Tracking Portal 2026 To Verification 13500

Fresh Customs Valuation Brings Long-Awaited Change

Under Valuation Ruling No. 2035 of 2026, issued by the Directorate General of Customs Valuation Karachi, FBR has revised customs values for 62 old and used mobile phone models. These values are now aligned with actual international market rates instead of inflated estimates.

Previously, customs valuation lists were outdated by more than a year and a half. During this period, many phone models lost resale value globally, while newer versions entered the market. Despite this, importers were forced to pay taxes based on old prices, creating disputes and delays at ports.

This new valuation system improves the process in several ways:

- Customs values now reflect real global used-phone prices

- Importers face fewer disputes during clearance

- Valuation is fixed instead of being decided by phone condition

- Transparency has improved for both traders and authorities

This step removes confusion and creates a more predictable import system.

You Can Also Read: Punjab Govt Launches 8070 Web Portal for Rs. 10,000

Why PTA Tax Automatically Drops After This Decision

Many people believe PTA tax is a fixed charge, but in reality, it depends on the customs value of the phone. When customs valuation is reduced, the total payable tax also comes down automatically.

In Pakistan, imported mobile phones are charged multiple taxes. These include customs duty, sales tax, income tax, and PTA registration tax. All these charges are calculated on the base value set by customs.

Because the base value is now lower:

- PTA registration charges decrease

- Overall import cost is reduced

- Final retail prices become more reasonable

This is especially important because high PTA taxes were forcing users toward non-PTA or patched phones, which created legal and security concerns.

You Can Also Read: PSER Online Registration 2026 To Avail Ramzan

Four Major Mobile Brands Get Maximum Relief

The biggest relief has been given to four mobile brands that dominate Pakistan’s used phone market. These brands are trusted by Pakistani users because they offer better performance, longer life, and higher resale value.

The brands benefiting the most include:

- Apple iPhones

- Samsung Galaxy and Note series

- Google Pixel phones

- OnePlus smartphones

These phones are commonly imported without boxes or accessories and sold as used or refurbished units. With lower customs valuation, traders can now price these phones more realistically for Pakistani buyers.

You Can Also Read: Metro Bus Card For Students Free Transport

What Lower Import Values Mean for Ordinary Buyers

Lower customs values directly translate into lower prices in local markets such as Saddar Karachi, Hafeez Center Lahore, and mobile markets across other cities.

For ordinary buyers, this decision means:

- Lower PTA tax at the time of registration

- Reduced final shop prices

- Better phone options within the same budget

- Easier access to flagship devices

Students, freelancers, online workers, and middle-income families will feel the biggest impact, as they usually prefer high-quality used phones over expensive new ones

You Can Also Read: Cm Laptop Scheme 2026 Online Apply Next Phase

Important Rule Importers Must Follow

FBR has introduced a clear condition to ensure this relief is not misused. Only genuine used phones will qualify under the new valuation ruling.

The main requirement is simple but strict:

- The phone must have been activated at least six months before export

- Importers must declare the activation date

- Customs officers will verify activation records during clearance

This rule prevents brand-new phones from being falsely declared as used and protects government revenue while still offering public relief.

Updated Customs Values for Popular Imported Phones

The revised valuation has significantly lowered customs values for commonly used models in Pakistan. Below is a sample comparison of popular devices under the new ruling:

| Mobile Phone Model | New Customs Value (USD) |

|---|---|

| iPhone 15 Pro Max | 460 |

| iPhone 13 Pro | 225 |

| iPhone 11 | 95 |

| Samsung Galaxy S23 Ultra | 255 |

| Samsung Galaxy S21 5G | 50 |

| Google Pixel 7 | 59 |

| OnePlus 11 | 92 |

These reductions directly lower PTA tax and make legal phone registration far more affordable than before.

You Can Also Read: PSDF Parwaaz Card Loan Repayment 2026

What Happens If a Phone Model Is Not Listed

If a specific phone model or brand does not appear in the valuation list, customs authorities will assess it separately under existing customs laws.

In such cases, valuation is determined using:

- Comparable import data

- International used-phone pricing

- Local market surveys

This approach allows flexibility while preventing misuse of the system.

How FBR Finalized These New Rates

According to customs officials, the new values were finalized after a detailed and structured process. This was not a random decision or political move.

Authorities carried out:

- Meetings with importers and stakeholders

- Review of 90 days import data

- Physical surveys of local phone markets

- Analysis of international pricing trends

Because declared values often did not match real prices, market-based valuation methods were used to reach fair and balanced figures.

You Can Also Read: Punjab Kisan Card Status Check 8070 Using CNIC

Positive Impact on Market and Consumers

This decision is expected to bring long-term stability to Pakistan’s mobile phone market. By reducing unrealistic taxes, the government has encouraged legal imports and proper PTA registration.

Key benefits include:

- Reduction in under-invoicing

- Increased PTA compliance

- Decline in non-PTA phone usage

- Better transparency in imports

Instead of relying on inflated taxes, the government can now collect revenue through fair valuation and higher compliance.

Final Words

From a ground-level journalistic perspective, this move by FBR reflects an understanding of real market conditions and public difficulties. By aligning customs values with international prices, the government has reduced PTA tax pressure without weakening regulatory control.

For ordinary Pakistanis, this means more affordable smartphones, fewer illegal devices, and a healthier mobile phone ecosystem. If implemented consistently, this policy can restore confidence among buyers, traders, and authorities alike.