New PTA Tax Values For Samsung Galaxy S23 Series

New PTA Tax Values For Samsung Galaxy S23 Series In Pakistan, the price of a smartphone does not end at what you see in the market. PTA tax has become a deciding factor for most buyers, especially those looking for used flagship phones. Over the past few years, many people have delayed upgrading their phones simply because PTA approval made even used devices too expensive. This is why any reduction in PTA tax directly impacts purchasing power and buyer confidence.

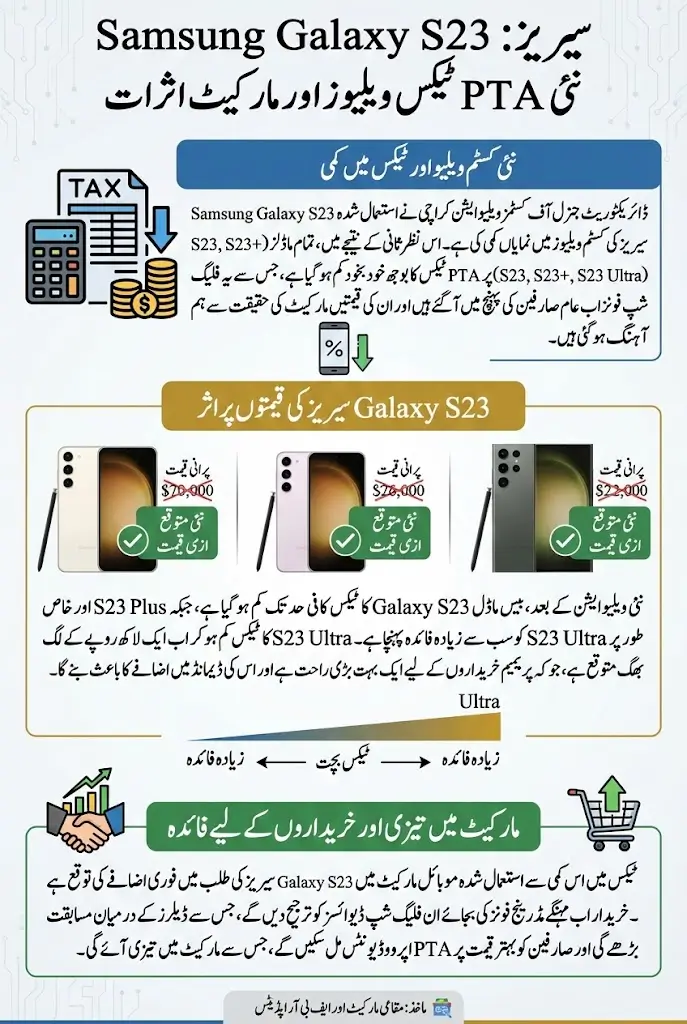

Recently, after observing new tax updates for the used iPhone 15 series, attention has now shifted to Samsung users. The Galaxy S23 series, which is already popular in Pakistan’s used mobile market, has received revised customs values. From what we have seen in local markets and importer discussions, this change is expected to lower prices noticeably and bring premium Samsung phones closer to the reach of ordinary users.

You Can Also Read: Benazir Kafalat New Qist: New vs Old Beneficiaries

What Changed in Customs Valuation for Used Smartphones

The Directorate General of Customs Valuation Karachi has revised the customs values for imported used mobile phones. These customs values are extremely important because PTA tax is calculated on them. When the base customs value goes down, the total PTA tax automatically reduces, making the phone cheaper for the end user.

This revision covers several major brands that dominate Pakistan’s used phone market. Samsung, Apple, Google, and OnePlus devices are included, which shows that the government is trying to align tax values with actual market realities rather than unrealistic price assumptions.

Key points of the new valuation system include:

- Lower customs values for used flagship phones

- Reduced PTA tax burden for buyers

- Faster market adjustment within days of implementation

You Can Also Read: 9999 Ramzan Relief Scheme 2026 Step-by-Step

Samsung Galaxy S23 Series Included in the Latest Update

Samsung’s Galaxy S23 lineup is among the most demanded Android flagship series in Pakistan. Many users prefer Samsung because of its strong cameras, long software support, and reliable performance. Due to this demand, used S23 phones were already selling fast, even before PTA approval.

With the inclusion of the entire Galaxy S23 series in the revised customs valuation list, buyers now have clearer expectations about pricing. Whether someone is looking for a compact flagship or a power-packed Ultra model, all variants now benefit from reduced tax calculations.

The updated list includes:

- Samsung Galaxy S23

- Samsung Galaxy S23 Plus

- Samsung Galaxy S23 Ultra

You Can Also Read: Ramzan Relief Package 2026 for Poor and Deserving

Updated Customs Value for Samsung Galaxy S23 (Base Model)

The base Galaxy S23 has received a customs value of $140, which converts to approximately Rs. 36,397. This revised valuation is much closer to the actual used market price of the device and removes the excessive tax pressure buyers were facing earlier.

From market observations, this change will directly increase demand for the base Galaxy S23. Many buyers who were previously stuck between mid-range phones and used flagships will now find the Galaxy S23 a much better option.

Expected impact in the market:

- Increased demand for PTA-approved units

- Faster resale movement

- Stronger competition among sellers

You Can Also Read: IESCO Online Bill Check by 14-Digit Reference Number

Revised PTA Tax Breakdown for Galaxy S23 on CNIC and Passport

PTA allows two registration methods: CNIC and passport. This difference plays a crucial role in final pricing. For many buyers, passport registration is cheaper, but not everyone has access to it.

With the new customs value, PTA tax for the Galaxy S23 has become more reasonable under both options. Buyers should still check which method applies to them before finalizing a deal.

You Can Also Read: Green Tractor Scheme 2026 Apply Online Date Extended

Samsung Galaxy S23 Plus: New Import Value and Market Impact

The Galaxy S23 Plus is preferred by users who want a larger display and better battery life without paying Ultra-level prices. Its customs value is now set at $160, which converts to around Rs. 44,796.

This change has already started influencing dealer expectations. From what we have seen, sellers are preparing to revise prices once the new valuation is fully implemented. The S23 Plus is now expected to compete strongly with upper mid-range phones in Pakistan.

Market effects include:

- Lower PTA approval cost

- Better value for money

- Increased availability of PTA-approved units

You Can Also Read: E Taxi Scheme Online Apply 2026 For Next Phase

Why Galaxy S23 Ultra Is the Biggest Beneficiary

The Galaxy S23 Ultra has always been a dream phone for many Pakistanis, but PTA tax made it extremely difficult to afford. With a revised customs value of $255 (Rs. 71,393), the situation has changed significantly.

This reduction means that a PTA-approved Galaxy S23 Ultra may now be available at around Rs. 100,000, depending on condition and seller margin. For a phone that offers top-level camera performance, display quality, and long-term software support, this price feels far more justified.

Reasons Ultra benefits the most:

- Highest absolute tax reduction

- Strong demand among premium buyers

- Clear advantage over new mid-range phones

You Can Also Read: PTA Tax Reduction on 4 Imported Mobile Brands

Estimated Retail Prices and Margin Factors

Retail prices are never fixed in Pakistan. Shop location, phone condition, storage variant, and seller margin all play a role. Even with reduced PTA tax, prices may vary by Rs. 20,000 to Rs. 30,000 from shop to shop.

However, based on current calculations and market trends, buyers can expect the following approximate PTA-approved prices once the new valuation takes full effect.

| Samsung Model | Estimated PTA-Approved Price |

|---|---|

| Galaxy S23 | Around Rs. 55,000 |

| Galaxy S23 Plus | Around Rs. 65,000 |

| Galaxy S23 Ultra | Around Rs. 100,000 |

You Can Also Read: 8171 Tracking Portal 2026 To Verification 13500

Timeline: When These Prices Will Reflect in the Market

According to importers and market sources, these new PTA tax values are expected to be applied within one week. Phones imported after this update will reflect the reduced tax immediately.

Buyers should be careful with older stock, as some sellers may still quote higher prices. Always ask about the import date and PTA approval receipt to avoid overpaying.

You Can Also Read: Punjab Govt Launches 8070 Web Portal for Rs. 10,000

Important Buying Tips for Used PTA-Approved Phones

Buying a used PTA-approved phone requires attention. Many buyers lose money simply because they trust verbal claims instead of verifying details.

Before purchasing:

- Check PTA status using the IMEI

- Match IMEI with the tax payment receipt

- Compare prices from multiple shops

You Can Also Read: PSER Online Registration 2026 To Avail Ramzan Subsidy

What This Means for Samsung Buyers in Pakistan

This update is a major relief for Samsung users in Pakistan. Instead of settling for overpriced mid-range phones, buyers can now consider used flagships that offer far better performance and durability.

It also pushes the market towards more realistic pricing, which benefits consumers in the long run. Competition among sellers is expected to increase, leading to better deals.

You Can Also Read: Metro Bus Card For Students Free Transport

Final Thoughts

From what we have seen in the market, this is one of the best opportunities in recent months for buyers interested in the Samsung Galaxy S23 series. The PTA tax reduction has made these phones more accessible and financially sensible.

If you were waiting for prices to drop, this update clearly works in your favor. Just make sure to verify PTA approval properly and avoid rushing into overpriced deals.