Gold and Silver Prices Hit Historic Peaks in Pakistan

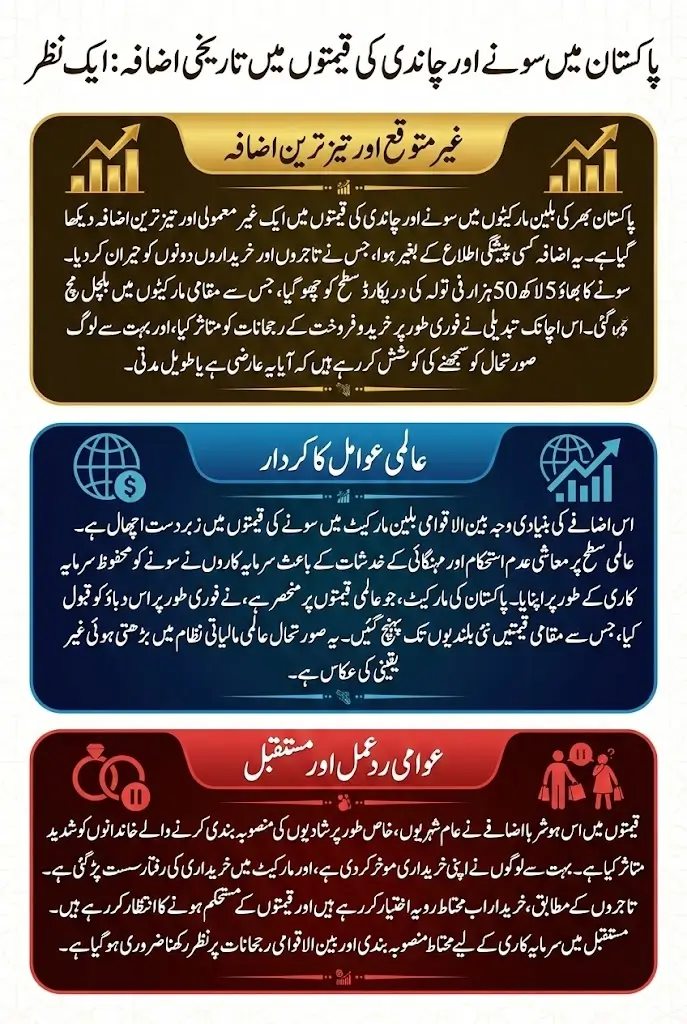

Gold and Silver Prices Hit Historic Peaks in Pakistan bullion markets across Pakistan experienced an extraordinary moment as gold and silver prices surged to levels never seen before. From Karachi to Lahore, traders were visibly stunned as rates climbed sharply within a single trading session. This sudden movement was not gradual or expected; it was fast, aggressive, and powerful enough to immediately affect buying behavior in local markets.

What made this situation more serious was the timing. Many families were already planning purchases for weddings and savings, but the record-breaking prices forced them to pause. The local bullion market, which usually remains active despite fluctuations, slowed down as people tried to understand whether this rise was temporary or the beginning of a new long-term trend.

You Can Also Read: Parwaaz Card Punjab – Get Rs 3 Lakh Interest-Free Loan

Market Shock: Precious Metals Break All Previous Records

During my visit to the bullion market, shopkeepers were repeatedly changing price boards, something rarely seen in such a short time. Senior traders admitted that even during previous economic crises, they had not witnessed such a steep daily increase. The rise did not give buyers time to react, which created confusion and hesitation.

For ordinary citizens, gold has always been considered a safe and reliable asset. However, these new price levels suddenly placed gold beyond the reach of many middle-class households. The psychological impact was clear, as people stopped buying and started asking questions instead.

Key market reactions included:

- Immediate shock among traders and buyers

- Sudden slowdown in retail gold purchases

- Increased inquiries without actual buying

You Can Also Read: STS Portal Online Apply And Check Results

International Bullion Rally Sparks Local Impact

The driving force behind this surge came from the international bullion market, where gold prices jumped sharply to a historic level. Since Pakistan relies heavily on global pricing for gold imports, the local market responded instantly. The connection between international bullion trends and domestic prices became more visible than ever.

Global investors are currently facing uncertainty due to economic instability, inflation fears, and weakening currencies. In such situations, gold becomes the first choice for protecting wealth. Pakistan, being part of this global system, absorbed the pressure directly into its local prices.

Major global influences included:

- Strong demand for safe-haven assets

- Investor movement away from risky markets

- Rising uncertainty in global financial systems

You Can Also Read: Benazir Income Support 8171 Qist 2026 Via Digital Wallet

New Price Benchmarks Set in Domestic Markets

As international prices soared, Pakistan’s gold rates crossed historic milestones. The price of one tola and 10 grams reached levels that traders had only discussed hypothetically in the past. These figures are now being used as new reference points in market discussions.

For local consumers, these rates changed buying plans overnight. Jewelers reported that customers were more interested in understanding price movements rather than making purchases. This shift shows how sensitive the domestic market is to sudden global changes.

You Can Also Read: Free Solar Panel Scheme Phase 2 Start In 2026

Latest Gold and Silver Prices in Pakistan

| Metal Type | Quantity | Latest Price (PKR) |

|---|---|---|

| Gold | 1 Tola | 551,662 |

| Gold | 10 Grams | 472,961 |

| Silver | 1 Tola | 11,911 |

| Silver | 10 Grams | 10,211 |

Silver Follows Gold’s Upward Momentum

Silver also moved upward alongside gold, reflecting the same international pressure. Although silver does not usually attract the same level of attention, its price movement confirmed that the entire precious metals market was under strong upward momentum.

In Pakistan, silver is often preferred by small investors who cannot afford gold. However, the recent rise has reduced that affordability, forcing many to reconsider even silver purchases. Traders noted that silver demand remained steady, but buyers were more cautious than before.

Reasons behind silver’s rise included:

- Strong international silver prices

- Market movement following gold’s direction

- Continued interest from small-scale investors

You Can Also Read: Great News Regarding Employee Allowances

Key Factors Driving the Sudden Price Explosion

After speaking with market analysts, it became clear that this surge was driven by a combination of global and economic factors rather than any single event. Gold reacts quickly to uncertainty, and once prices start rising internationally, local markets have little room to resist.

Pakistan’s import-based bullion system means that any global change immediately reflects in local prices. This dependency makes the market more vulnerable during times of international instability.

Key contributing factors were:

- Global economic uncertainty

- Increased demand for physical assets

- Reduced confidence in paper investments

You Can Also Read: Punjab Ration Card Scheme For Poor And Deserving People

Consumer Behavior Shifts Amid Record Prices

The most noticeable change was in consumer behavior. Where buyers usually negotiate and finalize purchases quickly, many now chose to step back. Jewelers confirmed that while footfall remained high, actual sales dropped significantly.

Families planning weddings and long-term savings began postponing purchases, hoping for price correction. This cautious approach reflects growing awareness among consumers who no longer rush into buying during sudden market spikes.

Common consumer trends observed:

- Delaying gold and silver purchases

- Reducing planned buying quantities

- Waiting for price stabilization

You Can Also Read: Punjabs New Poverty Relief Program to Offer Rs 45,000

Traders’ Perspective on Market Volatility

Local traders described the market as highly sensitive and unpredictable. Some believe that prices may rise further if international uncertainty continues, while others expect temporary stability if global markets calm down. Despite differing opinions, most traders agree that volatility will remain high.

Experienced dealers advised customers to avoid emotional decisions. According to them, gold remains a long-term asset, but short-term buying during extreme price movements requires caution and proper understanding.

You Can Also Read: Ramadan Nighaban Package 2026 in Punjab

What This Means for Investors and Buyers Ahead

For Pakistani investors, this situation calls for patience and careful planning. Gold still holds its value over the long term, but sudden price jumps can lead to poor short-term decisions if buyers act out of fear.

From what I observed in the market, informed buyers are closely watching international trends instead of reacting emotionally. This balanced approach may help them protect their savings while avoiding unnecessary losses.

You Can Also Read: CM Punjab Laptop Scheme 2026 Phase-II