MCB Bank Suzuki Financing

MCB Bank Suzuki Financing Owning a brand-new car in Pakistan has become a serious financial challenge for many families. With vehicle prices going up and savings becoming harder to manage, people often delay buying a car even when they truly need one. In this situation, bank financing becomes a practical solution, especially when it comes with clear terms and trusted partners.

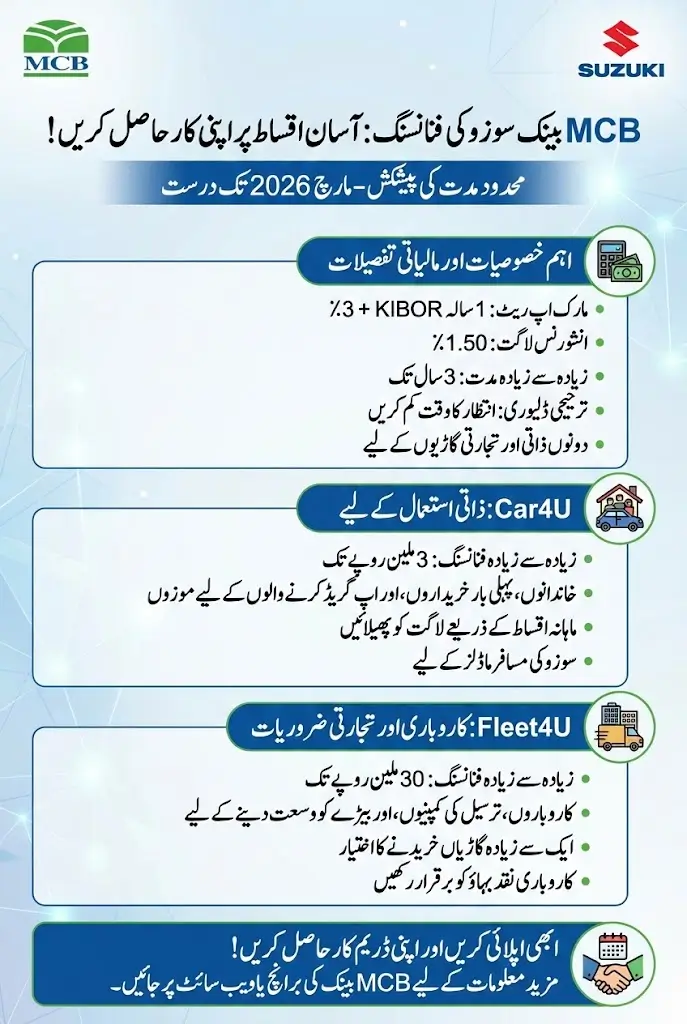

MCB Bank has stepped forward with a new Suzuki car financing offer under its Car4U and Fleet4U platforms, giving customers the chance to buy vehicles through easy monthly installments. This program covers both passenger and commercial Suzuki vehicles, making it suitable for families as well as businesses. The offer is for a limited time, which means buyers planning a purchase soon may find this to be a very useful opportunity.

You Can Also Read: Ramzan Nigehban Package 2026 Punjab Government Largest

MCB Bank Suzuki Auto Financing

MCB Bank is already known in Pakistan for offering different consumer financing products, and its car financing services have helped many people own vehicles over the years. With this latest initiative, the bank has partnered around Suzuki vehicles, one of the most commonly seen and trusted brands on Pakistani roads.

Suzuki cars are popular because they are fuel-efficient, easier to maintain, and have good resale value. By combining Suzuki’s reliability with MCB’s financing structure, this program is designed to make car ownership more achievable for ordinary citizens. Instead of arranging the full payment at once, customers can now spread the cost into manageable installments.

This offer is not just about buying a car; it is about providing financial flexibility at a time when household budgets are under pressure. For many families, this could mean upgrading from a bike to a car or replacing an old vehicle that constantly needs repairs.

You Can Also Read: BISP Launches Free SIM Facility for Women

Who Can Benefit from This Suzuki Car Loan Offer

This financing plan is built for a wide group of customers across Pakistan. It is not limited to big business owners or high-income individuals. In fact, the structure shows that MCB wants to support both personal users and commercial buyers.

For individuals, this is a chance to finally own a family car without waiting years to save the full amount. For businesses, especially small and medium enterprises, vehicle financing can help expand operations without disturbing daily cash flow.

This program may be suitable for:

- Salaried individuals planning to buy their first or second car

- Self-employed professionals who need a vehicle for daily work

- Small business owners managing deliveries or services

- Companies looking to expand their transport or logistics fleet

Because it covers both passenger and commercial models, buyers can choose a vehicle according to their actual need rather than financial limitations alone.

You Can Also Read: Negahban Program Online Check

Financing Costs and Markup Details You Should Know

Understanding the cost of financing is very important before signing any agreement. MCB Bank has shared the key financial structure of this Suzuki car financing plan, which helps customers estimate their future payments.

The markup rate is based on one-year KIBOR plus 3 percent. Since KIBOR can change with market conditions, the total markup may vary over time. This is a common practice in car financing in Pakistan, but customers should still discuss expected installment amounts with the bank before finalizing the deal.

The insurance cost is 1.50 percent, which ensures the vehicle remains protected during the financing period. Insurance is an essential part of car financing because the vehicle remains under the bank’s lien until the loan is cleared.

You Can Also Read: Parwaaz Card Selection Process After Registration

- Markup linked with one-year KIBOR

- Additional 3 percent added to the KIBOR rate

- Insurance coverage at 1.50 percent

- Structured repayment plan through monthly installments

These elements together form the overall cost of your car financing, so careful budgeting is always recommended.

Car4U Platform for Personal Suzuki Car Buyers

The MCB Car4U option focuses on individuals who want to purchase a Suzuki car for personal or family use. This is helpful for people who need a reliable vehicle for daily commuting, school runs, or family travel but cannot pay the full price upfront.

Under Car4U, customers can get financing of up to PKR 3 million. The repayment tenure can go up to three years, which spreads the cost over a reasonable period. Shorter tenures may mean higher installments but less overall markup, so buyers can choose according to their financial comfort.

- Middle-income households upgrading their vehicle

- First-time car buyers shifting from motorcycles

- Families needing a safer and more comfortable travel option

By reducing the burden of a lump sum payment, Car4U makes personal car ownership more realistic for many Pakistanis.

You Can Also Read: CM Solar Panel Scheme 2026 Phase 2 Easy Way

Fleet4U Financing for Business and Commercial Needs

For businesses, vehicles are not just a convenience; they are a necessity. Whether it is for deliveries, staff transport, or logistics, having reliable vehicles directly affects operations. MCB’s Fleet4U platform is designed with these commercial needs in mind.

Through Fleet4U, businesses can obtain financing of up to PKR 30 million. This higher limit allows companies to purchase multiple Suzuki vehicles under one structured financing plan. Instead of blocking large capital in vehicle purchases, businesses can use installments and keep funds available for other operational needs.

Fleet4U is beneficial for:

- Delivery and courier companies expanding their fleets

- Manufacturing or trading firms managing distribution

- Corporate organizations arranging employee transportation

This option supports business growth while keeping financial pressure under control.

You Can Also Read:

Priority Delivery for Suzuki Vehicles Under This Scheme

One of the biggest issues car buyers face in Pakistan is long delivery times. Many customers wait for months after booking a vehicle. This financing program includes a priority delivery feature, which can reduce waiting time for eligible buyers.

Customers who purchase Suzuki vehicles through MCB’s financing channels may receive faster delivery compared to regular bookings. For businesses, this can be very important when vehicles are needed urgently for operations. For families, it means enjoying the new car sooner rather than dealing with long uncertainty.

This added convenience increases the overall value of the financing offer and makes it more attractive compared to standard purchase methods.

You Can Also Read: 9999 Punjab Ramadan Relief Plan Explained 10000

Important Dates and Offer Validity

MCB Bank has clearly mentioned that this Suzuki car financing offer is valid until March 31, 2026. Since it is a limited-time program, terms or availability may change after this date.

Customers should not wait until the last moment, as loan approval and documentation can take time. Preparing salary slips, bank statements, and identification documents in advance can help speed up the process.

Before applying, it is wise to:

- Confirm eligibility criteria with MCB Bank

- Understand the full installment plan

- Ask about any processing fees or additional charges

Being informed in advance can prevent confusion later and make the financing experience smoother.

MCB Suzuki Financing Program

Below is a quick overview of the main features of this offer for easy understanding:

| Feature | Details |

|---|---|

| Bank | MCB Bank |

| Vehicle Brand | Suzuki Passenger & Commercial Models |

| Program Types | Car4U (Personal) & Fleet4U (Business) |

| Markup Rate | 1-Year KIBOR + 3% |

| Insurance Cost | 1.50% |

| Car4U Finance Limit | Up to PKR 3 Million |

| Fleet4U Finance Limit | Up to PKR 30 Million |

| Maximum Tenure (Car4U) | Up to 3 Years |

| Offer Valid Till | March 31, 2026 |

| Extra Benefit | Priority Vehicle Delivery |

You Can Also Read: eBiz Punjab 2026 Online Registration Now Open

Final Thoughts

From a practical point of view, this MCB Bank Suzuki financing program can make a real difference for many Pakistanis who are planning to buy a car but are held back by high upfront costs. By offering structured installments, coverage for both personal and commercial vehicles, and the added benefit of priority delivery, the bank has created a well-rounded financing solution.

Still, a car loan is a long-term commitment. Buyers should carefully review their monthly budget, future expenses, and job or business stability before applying. When used wisely, this financing option can help families enjoy safer travel and help businesses grow their operations without heavy financial strain.